A few weeks ago I woke up at an ungodly hour and drove down to an obscure pharmacy at the break of dawn – camping chair in hand.

A few hours later, someone stuck a needle in my arm, and I was symbolically transported into a whole new, post-pandemic world.

A world where lumber prices have increased by 700%, where JPEGs sell for $69M a pop, and where housing prices have gone parabolic – despite every sensible prediction to the contrary.

It’s also a world of paradoxes.

Amidst record job losses, the stock market is soaring. Amidst record inflation, gold is faltering. Amidst record uncertainty, borrowing is at a fever pitch.

The pandemic was supposed to usher in the ‘Great Depression 2.0’. That seemed a pretty logical outcome given a global lockdown.

Instead, it feels more like the Great Deferral. Most countries have utilized record money-printing to stave off a severe recession out of necessity – a way of keeping the wolves at bay while reserving full focus on slaying the biggest monster: COVID-19.

And at the moment, things feel eerily… fine. In fact, thanks to widespread currency debasement & subterranean interest rates, if you owned assets like stocks or real estate heading into the pandemic – you’re probably a lot richer right now.

But I think most people realize our current altitude is precarious. As with Icarus, there is a hair trigger threshold that separates a high-flying economy that’s running hot – from one that crosses the point of no return.

And once the wax melts off the wings, freefall is inevitable. Hopefully the people who run the show can somehow reduce the altitude a bit and pull off a soft landing. We’ll see.

For entrepreneurs, COVID has been the mother of all catalysts. We’ve seen massive trend accelerations that have effectively time-warped entire industries into rapid digital transformation – to the point where many companies are literally 10 years ahead of their pre-pandemic trajectory.

Other industries have been less fortunate – and in some cases, COVID has materially downgraded the outlook for certain sectors indefinitely.

At any rate, regardless of whether the scales have tipped to your favor or your detriment – one thing is certain: Things are different now.

This isn’t 2021 as we imagined it in 2019. This is a very different timeline. Let’s take a look at what’s been accelerated, what’s been left behind – and what might happen next…

Selective Time Warps

While far from comprehensive, let’s take a look at some key sectors where COVID has triggered outright megatrends, effectively advancing the existing trends in certain industries as much as 10 years sooner than projected…

An Involuntary, Global Crash-Course in Ecommerce

When COVID officially introduced itself as a crisis in Feb, 2020 I was heading up the Apps division of a Shopify-focused SaaS company.

Initially, we were bracing for the impact of a global supply shock. I assumed that we’d see warehouses, shipping ports, and basically the entire global supply chain screech to a halt.

While there was certainly some disruption… it was surprisingly short-lived. Most countries quickly moved to prioritize anything around trade channels as essential.

Equally as surprising was the demand side of the ecommerce coin. I was also bracing for a total collapse in consumer spending, for obvious reasons. Amazingly – barring a few sectors – ecommerce literally exploded.

Shopify saw record growth, to the point where as of April, 2020 they were seeing record traffic levels across their networkevery day. Insanity.

Now, at first glance, much of this could be considered transitory. I mean, obviously people are going to shop online when there’s literally no other option.

But importantly, Shopify (and ecommerce in general) also added a record number of new merchants in 2020, with QoQ growth running at ~ 70% through 2020.

In their own words:

“There’s a shift happening in the world of commerce, and we’ve all felt it.

“2020 has accelerated the industry by a decade, permanently altering the way entrepreneurs start, run, and grow businesses, as well as how consumers choose to shop and pay. We’re on the brink of a new era of commerce.”

Report: The Future of Commerce (2021)

And this is where the pandemic as a catalyst has forever advanced ecommerce as an industry – by accelerating both supply and demand!

Basically, a much larger chunk of the planet now buys stuff online regularly. And a much larger % of businesses are now selling stuff online.

This has profound implications & knock-on effects across hundreds of industries. But perhaps none moreso than brick & mortar retail…

Retail 2.0: Cashless, Cashierless & Contactless

In some ways, a pandemic was a perfect storm for hyper-innovating the “coexistence” of Ecommerce with Brick & Mortar. Rather than replace the main-street storefront, Ecommerce has become a sort of augmentation.

For example, things like BOPIS (Buy Online, Pickup In Store), Curbside Pickup and Local Delivery were rare, anomalous gimmicks pre-pandemic. Today, they are pretty much table steaks for any serious retail location.

Additionally, while not mainstream yet, COVID has certainly bolstered the case for “Cashierless” shopping as a legitimate outcome in the near future. Amazon Go is the main example, but the market is seeing some well-funded competitors start to emerge as well. Just a matter of time.

A few things in particular stand out as potentially paradigm-shifting…

- Local storefronts can now drive online sales without (necessarily) shipping, delivering or warehousing

- Consumers can now support local, small businesses just as easily as shopping on Amazon

- BOPIS & Curbside in particular incentivize the use of apps & digital wallets vs cash or conventional cards… this acts as a potential catalyst for Fintech & Crypto

- This “augmentation” brings forward a ton of net-new digital marketing demand & service categories – expect a whole new breed of agencies, consultants & tech startups to emerge around this.

Bottom line: Without question, brick & mortar retail has taken a massive hit in 2020. But it’s not down for the count. There’s been a metamorphosis – a blending of two worlds.

And it’s a world that’s still rapidly changing shape.

B2B Joins the 21st Century. (Finally).

When it comes to embracing the brave new digital world, you could’ve previously argued that “procrastinate” rhymes with “B2B”.

That’s because until very recently, traditional B2B industries have still largely been living in the “digital dark ages” with their marketing & sales strategy.

We are talking about billion-dollar companies whose entire sales process amounts to attending a few trade shows each year… because, well, that’s what’s worked good enough for as long as anyone can remember.

Rolling out a truly digital sales strategy is something that very few B2B firms in the “old world” have actually done – let alone done well.

And then COVID showed up…

No more trade shows. No more conferences. No more business travel. No more face-to-face selling.

For a lot of long-established companies, this meant rapidly figuring out how to move their sales ops online – and finally taking it seriously…

As McKinsey & Co puts it…

“The COVID-19 pandemic forced B2B buyers and sellers to go digital in a massive way. What started out as a crisis response has now become the next normal, with big implications for how buyers and sellers will do business in the future.”

McKinsey: How COVID-19 Has Changed B2B Sales Forever

This isn’t a passing trend. The companies who’ve started to see results from these new channels are going to ramp it up even harder.

And those that haven’t yet seen results / haven’t yet digitalized are also going to aggressively lean in – they need to figure this out, or watch their market dwindle away.

Among many other knock-on effects, this has created an epic opportunity for marketers, niche publishers & agencies going forward – as the newfound push into digital has effectively “awakened” hundreds of formerly untapped niche markets that are now uber-profitable. (More on that further down).

White Collar Workers Have Made Themselves At Home

Now that roughly a billion desk jockeys around the world have had a full 1-year dose of the WFH experience, it turns out the vast majority of them want to keep doing that.

Forever.

In fact, a recent survey shows that about 60% of people say they would quit their job if forced to return back to the office, or at least not have the option of working remotely some of the time.

And for employers – most of whom saw that productivity truly didn’t suffer, and in many cases actually improved through the pandemic – this seems to be gaining widespread acceptance.

Some have even shifted to a remote-first environment indefinitely. Notable examples include Shopify, JP Morgan Chase, & Coca Cola – but the list is long and growing rapidly.

The fact is, whether companies like it or not – if an employee can be just as effective at home as at the office, then that’s likely where they’re going to be from now on. Or at least, they’ll be there a lot more often.

Think about the enormous societal and structural knock-on effects this will have (and is already having) on where & how people live. Just a few standouts at a glance include…

- Commuting. What’s the net result of no longer needing to spend hours per day hustling back & forth to work?

- Moving for work. Just landed a sweet job in Toronto – but you live in small-town Nova Scotia? Great! Just hop on Zoom a few times a day.

- Free time. Let’s face it – nobody’s actually doing anything productive for a full 8 hours a day. It’s probably more like 3-4 hours at best. Which frees up a lot of time for things like side hustles, exercise, education / upskilling, etc.

- Savings. If you can earn a San Francisco salary from small-town Colorado – your net savings rate will be monstrously better than someone who’s paying 6 figures a year just on housing & taxes. (Now, of course, this is a sword with two edges, which we discuss further down).

And that’s just the iceberg’s tip.

Bottom line: The mainstream adoption of remote-first as a default will have enormous impacts on how most people will structure their lives from this point forward.

The explosion in demand for larger houses in the suburbs through the pandemic is just the beginning. It’s merely impact #1 out of #1,000. There will be cascading impacts for years to come as people re-order their lives around this new reality.

All Street Bets

Robin Hood. Gamestop. AMC. Silver Squeeze. Diamond Hands. Deep Fucking Value. Stonks Only Go Up…

If any of that made an inkling of sense, then you’re probably on reddit – or at least privy to what’s been going on.

In a nutshell, there’s an infamous subreddit (forum) called Wall Street Bets –WSB for short – and it’s filled with nihilistic, meme-laden “stock picks” posted by what seems to be a bunch of angst-filled teenagers.

And up until recently WSB was basically just a parody community. Something to chuckle about on a podcast, or a place to browse for a few minutes a day as a boredom killer – it’s admittedly hilarious at times.

During the pandemic, though, WSB and a number of similar communities saw record user growth. Literally millions of new users joined aboard. (One of the many knock-on effects of paying your entire population to stay at home – with endless time and a bit of extra cash).

And then things got a little carried away…

WSB and its ilk began to realize that by brigading as a sort of deranged “collective”, they could actually influence the valuations of public companies – to the tune of billions of dollars.

For example, a few clever redditors figured out how to force certain stocks into a short squeeze scenario – where the impact to the stock’s valuation can be staggering.

In GameStop’s case, the stock – which was likely destined for bankruptcy – went from $4.70/share to as high as $300… a 64X increase in value!

Some of these cynical, meme-driven traders actually did make millions of dollars overnight. And on the other side of the coin – the hedge funds they were targeting incurred massive losses. To the tune of $6 Billion, roughly.

As it turned out, this was just the beginning. Several other targets were identified, and this “meme stock phenomenon” eventually became a dominating theme across mainstream business news (and it still is). And many think this has actually permanently changed how the stock market is going to operate going forward.

But the larger impact here is that a substantially larger percentage of Millennials and Gen Z’s have become familiar with buying stocks / options, trading strategies, etc. Tens of millions more than before the pandemic.

This will drastically change market dynamics – because this is a new type of investor who understands (and can benefit from) the the network effects of not just spotting trends… but actually creating them.

Bottom line: Wall Street’s new hotshots are no longer the stuffy, suit-wearing hedge fund managers of yesteryear. These days it’s whoever can cultivate a big enough audience on places like Reddit, Discord & TikTok.

Regulators will need to catch up to this new reality. And for Gen Z’s & Millennials, this may become the primary wealth strategy (vs housing) in a world with near-zero interest rates.

Collateral Damage

Similarly to the above megatrends, let’s look at a few areas where COVID has thrown some heavy punches – and in some cases, possibly even some death blows…

Office Space 2.0

In direct correlation to the rise of a lasting, mainstream WFH culture, the pandemic has similarly downgraded demand for physical office space across virtually every white-collar industry.

While some of this is transitory – demand will snap back to some degree as restrictions loosen – there’s no question that the next normal of how companies use office space (and how much space they need) is materially reduced.

This is anecdote, but literally every founder or CEO I personally know in my local tech circle has either downsized their square footage (substantially), or in some cases they’ve gone entirly remote-first, and now they just rent hot desks at WeWork, Regis or similar for a small percentage of their staff, for weekly meetings, etc.

I’m sure paying $15,000 /mth in rent for a space that nobody used in nearly 2 years – generally with no drop in productivity or even increased productivity from the team – made this decision fairly obvious.

This demand pullback is likely permanent.

Some knock-on effects I anticipate are as follows…

- Co-working spaces. Hot desks & on-demand flex spaces will see significant demand going forward. WeWork et al make so much more sense in this new reality, and I could see an “Airbnb” model working for this as well.

- Re-zoning. With the decreased demand for commercial space – especially in downtown core areas – along with heightened political pressure to increase housing supply in most countries currently, I think we’ll see a huge wave of Office > Apartment conversions over the next 2-5 years.

- Core no more. What happens in a city when tens/hundreds of thousands of workers who previously commuted downtown, paid for parking, went for lunch, etc… just stay in their suburbs? Demand spreads out, and in North America in particular, perhaps we see more of a European city structure – where there’s pubs & restaurants on every corner, and “micro downtowns” every few blocks.

In any event, the Office as a foundation of how the world runs has been downsized, possibly forever. There are some opportunities here – but also a lot of short straws drawn.

Cruises, Casinos & Churches

As with most viruses, COVID-19 has a preferred victim. In this case, it’s the elderly.

And through much of 2020 & 2021, for people 60 or older, avoiding groups & enclosed spaces wasn’t just a best-practice recommendation – it was a serious health measure. Especially for those in their late 80s+, where COVID’s fatality rate is double digits for anyone unvaccinated.

Accordingly, for many of the elderly going through this pandemic, every essential visit to grocery stores, banks and clinics was akin to crossing a field of landmines. The sense of fear & dread was palpable.

This isn’t something that everyone can just “switch off” after getting vaccinated. Unfortunately (and sadly), I think a material percentage of the elderly population will have lasting mental trauma for the foreseeable future, and will remain largely isolated for years to come.

What happens when 10-15% of elders (or more) simply don’t re-enter society once we officially ring the bell on the pandemic?

I don’t know, but I have a feeling that “Cruises, Casinos & Churches” (aka: anything catering mostly to retirees / elderly demographics) have seen at least 10-15% of their TAM erased indefinitely.

Not Even Remotely Employable

For every action, there is a reaction – and the jobs economy is no exception.

With the rise of remote employment as a de-facto standard across most white-collar professions, there comes a range of pros & cons for all involved.

Most obviously, while there’s now a whole new ocean of job opportunities for employees – there’s also 1000X more fish for companies to choose from…

All of a sudden, this means employers can be a lot pickier in who they hire – now that eligible talent includes basically anyone within a 2-3 timezone bracket.

Accordingly, job seekers who live in HCOL cities may have suddenly just become a lot less desirable going forward. Why pay someone 2-3X the salary – who’s just going to be working from Zoom & Slack anyway – just because they live in an absurd housing market?

It remains to be seen how this will actually take shape, and it’s unclear who has the “upper hand” as yet (employees vs employers), but at the very least – when you can work from anywhere, the “where” part of the equation carries a lot less weight.

Bottom line: I don’t see any scenario where this somehow works out favourably for those who live in expensive cities like Vancouver, San Francisco or New York.

So paradoxically, living in a “desirable city” may now actually be limiting to your career.

Note that while many sectors like manufacturing, tourism, hospitality, events, etc. were also heavily impacted by the pandemic, the reasons were obvious – and this should be transitory, only impacting currently operating businesses, and not the underlying supply / demand.

The Crystal Ball

Lastly – some predictions. Full warning that my crystal ball works just as well as anyone else’s (aka: these are wild guesses), but for what it’s worth, here’s what I’m looking at…

Salvation by Inflation

For reasons we all understand, virtually every country on the planet has had to take extraordinary measures over the past 2 years to avert economic collapse.

As a result, the level of money printing by most central banks has been nothing short of astounding. The last time we’ve seen printing on this scale was in the 1940’s (WWII).

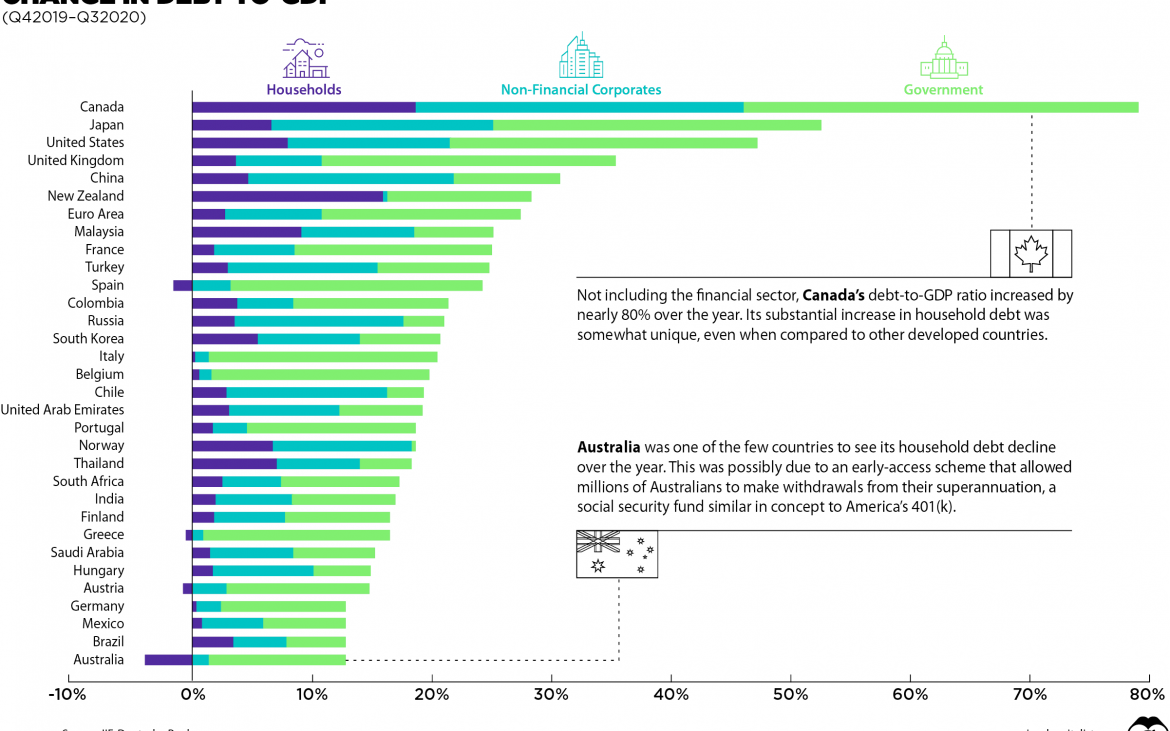

And up here in Canada, we’re unfortunately leading by example when it comes to expanding our Debt-to-GDP ratio by levels which dwarf even those of the runner-up contender (Japan).

As far as what this actually means for us as individuals in the long run… honestly, it’s above my pay-grade.

Some very smart people have vastly differing opinions on whether current inflationary signals are simply transitory – or whether we’re truly headed into a “wheelbarrow money for bread” scenario.

Here’s a tremendously detailed article by Lyn Alden that compares the money-printing in 2008 vs 2020, and explains how it actually works, and the situations where it can actually become inflationary.

Alden’s final consensus is, of course, that it depends... but I think, reading between the lines, her cards begin to show a bit in this section…

“Many people who saw the inflationary non-event from 2008-2014, are suggesting that QE is inherently deflationary, and that it won’t cause inflation this time either.

“I’m glad many people feel that way, because I’m happy to buy their gold from them on dips. I bought plenty of precious metals back in 2018 and have cooled my purchases since then due to the notable uptick in price, but am still happy to dollar-cost average into them at these prices, or buy on dips. I also like cheap natural resources more broadly, as well as high-quality equities, real estate, Bitcoin, and other scarce assets for a diverse mix, with a long-term view.”

Quoting Lyn Alden, from: Money-Printing: 2020 Vs. 2008

Translation: Post-pandemic side effects may include substantial inflation. Hedge yourself accordingly.

Regardless of what actually happens, we are in uncharted waters. And what I do know is that – whether it’s transitory or just the beginning – a perfect storm of COVID-driven factors including supply shock, near-zero interest rates and record household savings rates have distorted virtually every market into runaway price escalation.

Anecdotally, where I live, the median single-family house price has increased by about $270,000(!!!) during the pandemic. Groceries are noticeably 20-30% higher at the till. Oil prices are now above where they were in 2019. Gainfully employed families are living in campsites because there’s literally nowhere to rent, or they’re priced out.

The list goes on.

And… inevitably, now that the Pandemic Bill is coming due at a government office near you, expect to see the mother of all tax hikes rolling into your federal & regional budgets over the next 12-24 months.

Basically, the chasm between accumulating wealth with income vs asset appreciation has been profoundly widened by COVID, and I predict that we have at least another 1-2 years of this chasm-widening before it gets better.

Governments only have a single strategy for dealing with this – raising rates – but can only do so at the expense of stifling badly needed economic growth. It is a catch-22 of planetary proportions. They will hold off until the situation becomes truly dire.

My Prediction: Life is going to become increasingly expensive in the short to medium term – especially if you don’t own inflationary assets. Watch for behavioral & spending changes in your customers, and be prepared to pay more for acquiring new talent.

Also, be prepared for an intense overcorrection if key governments let inflation “fly too close to the sun”… which would result in sudden, knee-jerk rate hikes… subsequently accompanied by mass bankruptcies and asset values plummeting. Hopefully they can figure out a softer landing – but be prepared regardless.

Riding the Rails 2.0

During the Great Depression, an estimated ~ 2 million people snuck into trainyards and hitched their way from one city to the next in search of employment, adventure – and in many cases, just basic needs.

They were called Hobos, and they they would ‘ride the rails’, vagabonding across the country in response to being displaced by an economic collapse. A collapse fueled by a coalescence of factors, but most arguably demand shock & inflexible monetary policy.

Basically, asset values were decreasing, and the government stubbornly refused to intervene.

Today’s emerging economic crisis seems to be driven by exactly the opposite. Government intervention is unparalleled – and asset values are ballooning in response.

But just as before – millions of people are currently being displaced as a result. Here’s how I think this plays out over the next 2-3 years…

My predictions:

- Van Life, Tiny Homes, & Off-Grid Communities Go Mainstream. With each passing day, the prospect of homeownership for 20-30 somethings becomes increasingly unattainable. In response, I think a certain percentage (especially those without kids) will just opt-out of regular housing altogether, and embrace alternative living situations.

- Digital Expats. Another option for those who can work remotely (which is now a lot more people post-pandemic) is to move to countries with a significantly lower cost-of-living, but which still offer a similar standard of living. Places like Costa Rica, Estonia, Bali and others are about to see a huge influx of digital nomads who are fed up with paying as much as 6-figures/yr in pre-tax income just on housing.

- Early Inheritances. Most boomers with adult kids now realize that there’s basically no chance of them getting on the property ladder without an inheritance – and I think we’ll see more and more families turn to exotic solutions like Fraction to make this possible.

Fractional Unicorns

With the mainstream shift to remote-first as a default, along with my predictions above around the increasing irrelevance of HCOL cities & countries, I think it’s reasonable to say that if companies want to attract the best talent going forward – they’ll need to accommodate people who will likely insist on being able to travel for months at a time, or live on a beach for half the year – or indefinitely.

Stubborn companies will quickly find that their competitors are far more accommodating, and will lose all their best people to companies who are more flexible.

In addition – I also think that the real rockstars in an industry are increasingly reluctant to commit to full-time employment at the exclusion of other opportunities.

Once you’re in huge demand and the world is your oyster, the main risk to your career at that point isn’t being unable to find work – it’s hitching your wagon to the wrong horse.

My prediction: To reduce opportunity cost – and also to keep things interesting – I predict that the best, rock-star talent in most industries will basically adopt a consulting model, where it makes more sense to be “fractional full-time” for 3-4 different companies at a time.

In the marketing space, companies like MarketerHire and GrowthCollective basically enable this model already, where their service providers are all rockstars who typically take on 3-4 part time engagements at a time, where each engagement brings in anywhere from $6K – $12K /mo.

I expect this to grow substantially – and I think this model is where the best people will eventually gravitate towards in most industries.

Side note: A big opportunity for anyone interested is creating a “MarketerHire” for various sectors where remote-first has just become the new normal, post-pandemic.

Money 2.0

Given everything discussed so far; runaway inflation, housing costs, etc. – I think the stars are finally aligning for certain blockchain projects to begin taking root as pragmatic, real-world solutions.

In particular, I’m looking at the Decentralized Finance (DeFi) segment of the Crypto universe, and while it’s still the early innings, I’m increasingly convinced that we’re witnessing the birth of something massive & structural.

In a nutshell, DeFi is a framework for connecting your money to the internet ecosystem. I realize that sounds like a bunch of cryptobabble bullshit, but here are some examples of projects that exist right now:

- PoolTogether – A decentralized savings account and lottery pool where instead of earning interest on just your own money, someone in the community wins the combined interest on total deposits every week, which is often $50K+

- Augur – A decentralized betting platform where you can place bets on literally anything and create your own betting markets, without limits.

- Synthetix – A sort of derivatives “API” that lets you create synthetic assets that simply track the price action of things like stocks, commodities, fiat currencies – basically anything where price data can be pulled in programmatically. Developers can also build apps that utilize these synthetic assets in various ways.

- Aave – A lending/borrowing platform with APY’s that will blow away your conventional bank.

- Yearn – A community-driven “robo-advisor” that maximizes yield on your parked crypto & stablecoins. Again, the APY’s are insane.

- RealT – Buy fractional tokens of ownership in US real estate (mostly walkups & apartment buildings).

- GitCoin – Basically “Github for Web3”, but with financial incentives built into your contributions. Lets you contribute to opensource applications and simultaneously earn a stake in the projects as you build / fund them.

- OriginTrail – A global supply chain solution that uses blockchain technology to facilitate trading logistics across various industries. You can contribute / collect rewards by providing liquidity as a “Trace” tokenholder, or run a node on the opensource chain.

This is a huge topic, and my little summary + examples here barely scratch the surface.

I mean, it’s basically a new way to run the internet and our financial system, with an entirely new economic model. There’s no way to properly cover this here – it would take a dedicated series of blog posts – but if you’re interested, these articles are a good place to start:

Currently, DeFi and related crypto projects are still in the “Napster” phase of early adoption & real-world utility. And by that I mean that most people intrinsically know that crypto is going to be the eventual future of finance, and that decentralized blockchains will be the eventual future of the internet.

But, much like the early days of the internet – it’s anyone’s guess how this will actually take shape, and which platforms & apps will go on to become household staples.

There are still a few quantum leaps needed to go from Napster –> Spotify, but it’s obvious we’re on to something…

My prediction: The rate at which crypto goes mainstream will continue accelerating, and for starters, we’ll see “crypto-friendly” smart wallets like Square’s Cash App at the forefront of driving adoption into the more mainstream DeFi Apps.

(To paint the picture, Square’s CashApp alone has 36 Million active users. By contrast, the entire DeFi ecosystem currently consists of just 2.8 Million unique addresses… these are very early innings.)

But I’m confident that in the next 2-3 years we’ll see some legitimate killer apps emerge from the DeFi community that become widely adopted by Gen Z’s & Millennials in particular – as they’ll be the ones most disadvantaged by the conventional, post-pandemic financial system, and therefore most willing to explore exotic alternatives.

It will be equal parts mystifying & mesmerizing to watch this all unfold.

The First Wave

On more of a personal note, I’m excited to finally reveal something that I’ve been building in the background for over a year at this point…

The Lazy Marketer (2.0) is now officially live. You can check out the new site here.

Think of it as a ‘surf report’ service for internet entrepreneurs. We find perfect storms that are whipping up huge waves of opportunity – and then provide a map showing where they’ll arrive, along with a guide on how best to harness them.

Something I think a few folks might find useful given that we’ve officially entered uncharted waters…

Anyway, the first report launches early next week. It highlights a huge, COVID-induced opportunity for marketers… one that’s opened up hundreds of newly-untapped niches.

Niches where leads are worth $300 – $800 each. It’s a doozy 🙂

This was a huge, meandering blog post – and I get that this longform style isn’t everyone’s bag.

But since you’ll be hearing from me a bit more frequently going forward, I wanted to kick things off with a contextual foundation.

I felt it appropriate to lead with a thoughtful retrospective on the pandemic, as well as a forward-looking piece on what might come next. After all, a lot has happened in past year.

Also, hopefully this pulls back the curtain a bit into my framework for “wave-spotting” going forward.

So to the 6 people who made it to this part… thank you.

~ Chris

Wow.

Admittedly, I didn’t read every single word of this, but I think I read every main point and a lot of the supporting points. I like thought-provoking posts that connect a lot of dots.

Some of the secondary and tertiary knock-on effects of the pandemic are particularly interesting. I feel that the post-pandemic portions of this post are probably of the best value to most people, as it’s great to have some idea of the possible future that we can create for ourselves.

Lots of opportunities!

Thanks DK!

For sure re: knock-on effects… and it’s so hard to know how it will actually take shape. So many surprises so far, and the pandemic isn’t even “over” yet.

Will be a wild few years from here, IMO

Yay! I made the 6!! Good to hear your point of view as usual.

Great Hope (I’ll not mention the mRNA though, good luck with that giant experiment !) Succinct & yet full of vision. I also believe that the push to the new will drive millions of new customers through the clever well thought funnels online. On a practical not what SAAS do you recommend for seeing the Big Picture. I have been looking at tools like WickedReports & Oviond recently. GA4 looks the beast but man is it difficult to tame into a decent client based report of trackable ROI from a combo PPC & Organic approach. (Fast & Slow KISS methods)

Hi David – thanks for the feedback!

Re: All-in-one reporting dash for DM’s, I honestly haven’t really looked lately. The last couple years my team was using a mix of GA and SiSense + Segment (we needed complex queries in an environment that involved a few black box platforms, walled gardens, etc).

Probably depends on whether you need client-friendly stuff, or whether it’s just for internal tracking. I think DataStudio is probably best for most internal stuff, and for anything super intense, then a BI platform like SiSense.

For client reporting, I could see Oviond / WickedReports being great.

Thank you Sir – Great advice as usual.