A few months ago, a small creature – perhaps a bat or a pangolin – was placed in a cage, ready to be sold in the market district of an obscure Chinese city most of us never even knew existed.

The random vendor who loaded up his various creatures for the day had probably been doing the exact same thing for years. Along with tens of thousands of other vendors across the country.

But on that fateful day just months ago, this ordinary routine unwittingly sparked off a chain of events that – in a matter of weeks – has locked down entire countries, killed thousands of people, erased trillions in wealth, and changed the course of history.

Unfortunately, this is a story that’s still unfolding.

And it’s a story where you, me and everyone you know are directly involved.

It’s also a story that nobody was expecting, and for which nobody was prepared…

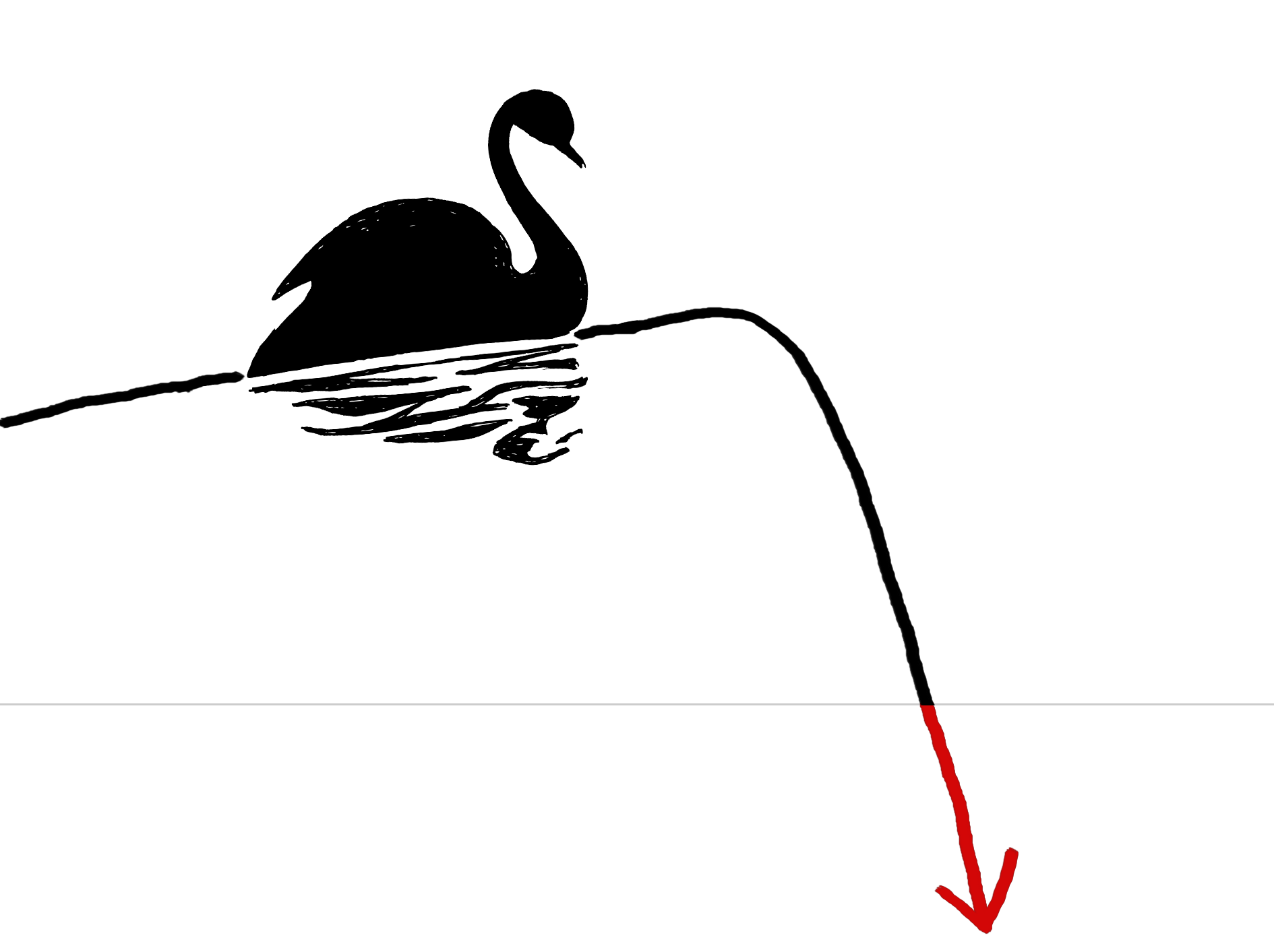

Enter the Black Swan

The black swan is a metaphor used to describe a completely unpredictable event that sets off a negative chain reaction, usually with severe consequences.

It embodies the unimaginable becoming reality. Some examples include:

- The assassination of Archduke Franz-Ferdinand, which set off a cascade of events ultimately triggering World War 1

- 9/11. Nobody imagined that passenger jets could become makeshift cruise missiles. Until it happened.

- The 2008 GFC. Nobody could’ve predicted the complete unwinding of America’s largest banks.

Another way to view the black swan is as the diametric opposite of a deus ex machina, a plot device that involves an unpredictable “save the day” event when all hope seems lost – such as the giant eagles in Lord of the Rings.

Without question, COVID-19 is the black swan of our lifetimes. We are witnessing history unfold.

This will be called the pandemic for decades to come, and it will become a colloquial time marker. Years from now, we’ll be referencing how things used to be before the pandemic; how things now work post-pandemic.

It’s going to fundamentally change the way we travel, how business operates, how we socialize, and how we organize our lives.

Millions of people and businesses will go bankrupt. A handful of economies may slide into total collapse.

More tragically, it’s possible that someone you know personally will fall victim to the virus itself. And that’s incredibly sad.

Whether directly or otherwise, this is going to impact you, me and everyone we know.

But while this is now unavoidably a major chapter in each of our own life stories, it’s not the end of the story…

The appearance of the black swan isn’t a harbinger of doom, per se. But it is a catalyst for severe and sudden change. And where you have volatility, uncertainty and substantial change – you’ll also find substantial opportunities.

Opportunities to help others.

Opportunities to impact a large audience.

Opportunities to be a first-mover.

And opportunities to grow; both personally and professionally.

With these things in mind, let’s take a look at what’s likely to transpire, how you can navigate your way through it, and how you can seize meaningful opportunities that you’ll be proud of later…

The New World Re-Order

I won’t mince words. The coming weeks are going to test each of us tremendously.

But this isn’t forever. And when we open the proverbial bunker sometime in the next ~ 4 months, and begin to reactivate a few of the routines & luxuries we previously took for granted – we’ll be stepping into a changed world.

There will be seismic shifts in geopolitical power, both on a regional and international scale. Some governments will take advantage of their “temporarily” expanded influence during the pandemic to restrict freedoms and consolidate power. Others will have had their illusory competence laid bare by the undaunted advance of a mindless enemy – against which they were woefully unprepared – and public trust will retract.

In particular, China’s CCP government may view the pandemic as a pivotal moment to seize a significant market share of global influence as they rally around their apparent victory over COVID-19. This crisis has also highlighted the stark vulnerabilities of a single country controlling most of the world’s supply chain – a fact that may either be another Ace in the CCP’s sleeve, or a strong reason for the West to diversify its procurement of critical supplies – such as medical equipment & generic pharmaceuticals.

In either case, when the dust settles, countries will shore up their defenses, tighten borders and prioritize self-reliance. For a time, the world may become less open, less free, and less prosperous. There will also be a renewed focus on healthcare, which is an obvious positive.

There will be herculean job-creation stimulus programs. By the time COVID-19 subsides, we may see unemployment levels akin to that of the Great Depression. The US & Canada have already had all-time record levels of EI filings, with millions of requests in the last week alone. Similar outcomes are playing out globally.

Most countries will be able to learn from the failed rescue attempts of the Great Depression and react accordingly. In short, Hoover’s idea of leaving it to the free market won’t make things better, and underfunded programs like FDR’s “New Deal” aren’t enough to resuscitate an economy so badly damaged. Ultimately, WW2 is what pulled the US & Canada out of the Great Depression. The wartime measures is what ended up being an inadvertent, publicly-funded all-country job stimulus program.

It will take similar measures to recover from this pandemic. This means that industries where the government is a buyer (construction, healthcare, manufacturing, etc) will be artificially buoyed for years to come.

An enormous amount of debt-fueled “wealth” will evaporate. The pandemic has killed the music, and there are a lot less chairs in the circle than there are people. The game is up.

This applies equally to individual consumers, small businesses, and huge publicly-traded companies. Leverage is great when times are good. It accelerates growth and makes big dreams come to life. And so long as there’s enough income or sales to service it, life goes on.

But as Warren Buffet puts it, leverage is also like having a knife welded to the steering wheel, pointed straight at your heart. Undoubtedly this makes you a more cautious driver. But it also means that even the slightest accident can be fatal. And in those terms, Coronavirus isn’t just an accident – it’s a goddamned train wreck. Any person or company whose liabilities exceed their assets (and specifically, their cash) is in serious trouble.

Millions will go bankrupt. As the aforementioned debt bubble gets squeezed, assets will be foreclosed, repossessed and liquidated for pennies on the dollar into a market with virtually no disposable cash. This will either drive down asset prices as a cascade of rugs get pulled en-masse… or in some cases it will freeze markets entirely.

This will be catastrophic for some. But for many others, it will reset the playing field, and give some otherwise “benched” players a chance to finally get in the ownership game (stocks, housing, businesses) at fair valuations.

The “virtual office revolution” will change skylines. Thanks to a global shutdown, we’re now witnessing an involuntary revolution of remote work culture being rapidly adopted across almost every industry.

Boardroom meetings, business travel & watercooler discussions are now all happening digitally – a trend that’s seen Zoom’s daily active users more than quadruple in just one month (sending their stock price up ~ 105% since January). I imagine Slack, Trello and other remote work platforms are seeing a similar surge of growth through the pandemic. This is obviously being driven by necessity, but the question is: what happens when the pandemic subsides, and life slowly returns to normal?

Does every employee immediately abandon the freedoms & autonomy that come with remote work? And does every employer rush to start spending millions of dollars again on business travel, as soon as restrictions lift? Let alone renew their exorbitant leases on prime office locations, for a team that hasn’t used it in months?

Sure, some companies will basically go back to normal. But I suspect a meaningful portion will happily accommodate remote-friendly policies, both out of necessity (retaining talent), and because of the tremendous savings to be had from reduced travel budgets & square footage requirements.

And this raises some key questions…

- What happens when employees don’t need to live in The City to work for companies based there?

- What happens when companies based in The City don’t need nearly as much office space?

- What happens when employees find that the leap between working remotely and self-employment is more accessible – and in many cases, safer – than they previously realized?

I think when the dust settles, we’ll see a fundamental shift in what the purpose of a City actually is. I think much of the draw of cities will remain intact. But I think there will be a ton of vacant office space in the next 3-5 years, and I also think suburbs will lose much of their relevance for a workforce that no longer tolerates a morning commute – and no longer views a singular employer as a stable source of income.

Bottom line: We are going to see a decade’s worth of change in a matter of months.

The post-pandemic world will be fundamentally different than the one we’ve known previously. And the predictions above are a tiny sample of what will surely be a sea of knock-on effects – for example, we’ll surely see permanent changes in education, tourism, and a host of other industry sectors once the dust has settled.

Which raises the big question…

What does this mean for you?

The Art of Taking a Hard Turn

Following the financial crisis of 2008, the last decade has largely been a straightaway as far as economic growth is concerned.

And if we view the stock market as the primary growth vehicle, the FAANG stocks – and all of their lookalikes – have been the proverbial gas pedal, driving record revenues (and record valuations) that have risen the tide for everyone.

In fact, for the last 10 years, all it took to make grow your money at 15%/ yr was to simply buy the S&P 500 index.

By comparison, actual GDP growth in the US over the last 10 years has only averaged about 2.5%/ yr…. fully six times less than the stock market. And so what we’re now seeing in the markets is the decline of optimism (valuations), a collective tightening of belts, and a renewed focus on fundamentals. The willingness to take on any risk is currently at an all-time low.

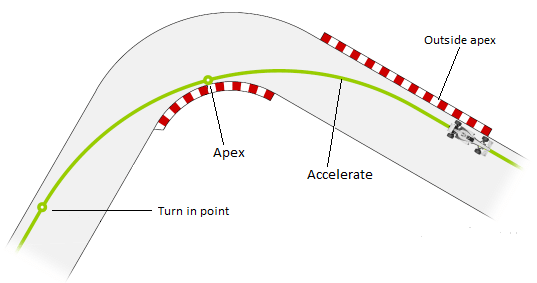

In other words, the straightaway has come to an end, and we are entering a very sharp corner.

Now, here’s the thing about succeeding on the racetrack; any idiot can look good on a straightaway, because there’s no real strategy. You simply hold the wheel and stomp the gas.

But it’s the corners where skill, timing & strategy come into play. And it’s the corners where the good drivers make their biggest moves and pass by competitors, and also where the novices fall behind (or hit the wall).

So let’s talk about the strategies you can take, right now, to navigate one of the sharpest turns in our lives…

1) Brake: Set up for the turn.

If you’ve ever been on a racetrack with an instructor, one of the first things you’ll learn is that timing your brake points leading up to corners is the biggest factor in your lap times, and not how “fast” you accelerate on the straights.

Enter a corner too hot and you’ll overshoot the apex and bleed off way too much speed as you exit the turn.

What this means is that right now is a critical moment to shed any discretionary expenses, nice-to-have services and otherwise shore up your cash. It also means moving quickly to consolidate high-interest debt, defer certain payments, and otherwise preserve as much cashflow as possible. Put the brakes on anything that isn’t mission-critical so you can maximize your options for recovery as the curve steepens.

2) Turn: Aim hard for the apex.

Cornering on a race-track is completely different than navigating an overpass ramp or a winding country road. On public roads and under normal driving, you just turn the wheel, maintain a steady trajectory, and stay in your lane.

On a race track, the idea is actually to avoid turning as much as possible, and instead draw “straight lines” through a corner. Practically speaking, as soon you as finish braking, you turn hard for the apex. This lets the car minimize the impact of angular momentum and maximize traction. See:

As it applies to our situation, aiming hard for the apex means there’s no room for compromise, waffling or “middle ground”. You must turn your entire focus towards the few, pivotal actions that will have the largest possible impact for your business – at the expense of anything less-than-momentous.

Some examples of what this might look like:

- For SaaS companies, this means pulling out all the stops and doing whatever it takes to retain existing customers. Offer extensions, huge incentives, creative payment options – whatever it takes.

- For Ecommerce companies, this means immediately shifting towards new demand. Pay close attention to support tickets, sales trends and competitor behavior to get a sense of what your customers’ buying behavior is now, and meet it.

- For Educational / Infoproduct publishers, this means re-positioning products to speak to the current situation, and it means taking drastic steps to capture market share while competitors waffle / do nothing.

- For Lead Generation companies, this means immediately re-calibrating offers that can remain relevant & profitable during a lockdown – and taking advantage of super low CPM’s across Facebook & Google Display while they last.

- For Consultants & Agencies, this means retaining clients at all costs, and immediately pivoting your service focus towards mitigation strategy / cash-raising for clients to help them make a “hard turn”.

- And for Employees, this means fighting tooth & nail to keep your job and maintain an income. This is the time to pull out all the stops and become utterly essential.

3) Accelerate: Gain some serious ground

Assuming your braking was done early enough, and your pivot to the apex tight enough – you’ll now be positioned to straighten the wheel and accelerate with full power through the exit.

On the race course, this is the opportune moment for passing competitors. And as it applies to our situation, after having preserved resources and maximizing resilience, you’ll be positioned to seize unique opportunities that won’t exist – or at least won’t be as potent – after the pandemic subsides.

These will vary depending on what you do and your available resources, but here are some examples:

- Launch a content campaign that specifically helps your customers (or industry) endure the pandemic, and positions you as a thought leader for a long time to come. This needs to be bold, tangibly helpful and authentic, or you’ll just be yet another stupid company sending out a “we’re here to help” message that means nothing.

- Hire awesome, previously inaccessible talent as your competitors are forced to downsize

- Move aggressively on M&A / specific asset purchases while risk is high and valuation arguments are paper thin – you could be securing some seriously deep value.

- Ramp up customer acquisition at record low CAC’s. As everyone else is pulling their marketing budgets, this is your chance to secure some truly astounding deals on media buys / insertion orders with publishers who are desperate to sell inventory.

- Renegotiate hard on your current fixed costs. This includes SLA contracts, office leases, enterprise software licenses, etc. Everyone will be scrambling to retain revenue, even if it means agreeing to a 50% haircut.

- Hedge against risk by using a portion of your cash to buy stocks of great companies (with strong balance sheets that won’t go bankrupt) that are, temporarily, trading at record-low valuations.

- Go to market with a simple product or solution that solves a huge, Coronavirus-driven pain point. Something you can build or re-purpose in 3-4 weeks, tops. Sell it cheaply and use it as a top-of-funnel feeder channel.

And so on. These are just a few examples.

In your own situation, deciding what to do during the Acceleration phase might be a matter of simply asking:

“What did I previously daydream about doing, buying or building – but that I delayed because I didn’t have enough time or money?”

Many of those things are probably now well within reach; and one of them could be a great candidate for your game-changing exit through this hard turn.

This won’t be easy.

For many of us, even if we aggressively brake, turn and accelerate – this will still be a major setback, and I suspect the recovery period won’t happen overnight.

And for some reading this, the pandemic will unfortunately be the knockout punch that resets everything to zero. Which is awful.

But we must take solace in understanding that this is hitting everyone. Nobody is immune to the virus, and neither is anyone’s livelihood.

This is a rare moment in history where all of humanity is facing the same enemy, the same hardships and the same fears. We are truly, for once, all in this together. And we’re all heading straight into an ominous turn of events – where what’s around the bend is anyone’s guess.

Ultimately, we can’t control why this is happening. The virus makes the rules.

But we can increase our odds of getting through it, and maintaining some momentum.

Rebooting in Safe Mode

Lockdown won’t last forever. The pandemic will subside. And in a few months time, society will begin to re-open.

This is likely to happen in stages, and right now, all eyes are on Europe as far as a workable “reboot” model that other Western nations can feasibly adopt.

One thing that’s certain is that until we have a vaccine (which is optimistically in 18 months), things will need to operate differently… and life will feel a bit strange. We will be emerging into a different world.

It will be a world that demands certain sacrifices, restricts previous freedoms, and compels us to adjust our prior expectations.

But it will also be a world where the fundamental rules of the game have changed. For some players on the board, this will wipe out their previous advantages.

Many others, however, will find themselves suddenly endowed with newfound advantages – since the new landscape will turn some of their “mundane attributes” into superpowers. Such as the ability to work remotely, being multilingual, or even having work experience in previously “unsexy” fields (like manufacturing, logistics, etc) that will see a surge in demand as brands reduce reliance on China. Among many others.

Regardless of where you find yourself on the “game board”, though, it’s important to realize that this is likely the most significant black swan event that anyone alive today will end up witnessing, first hand.

It isn’t just a game-changer; this is reshaping how the entire world works. And we won’t fully understand the extent of its knock-on effects util much later.

So whether you find yourself temporarily chairless now that the music has stopped, or whether you’re the new owner of a gilded throne, do your best to avoid attributing the outcome to your own design. This is basically an asteroid impact, where your unwitting coordinates on the map is the single largest “success factor” in the equation.

Instead, focus on what you can control. And focus on the profound opportunities that will emerge through an accelerated period of intense change.

Last – considering that for most of us, this will be the defining chapter of our lives – let’s make sure we rise to the occasion, and act in ways that we can be truly proud of, years from now.

Perhaps that’s the biggest upside of emerging into a new world: This is a chance to recalibrate our own values, and reset our own internal goalposts.

Life will surely be different. And hopefully, more meaningful.

I truly hope you & yours are in good health, and pulling through okay – all things considered.

Over in Chris-land, it’s been a wild ride, but we’re holding it together, at least so far.

Stay safe, friends.

And, stay tuned.

~ Chris

PS: Regarding these newfound advantages – and the post-pandemic trends that will drive them – this is something I’ll be covering in a lot more detail in the coming weeks.