It was the turn of the millennium, and Guinness was in trouble; an old man’s drink trying to reinvent itself.

Their primary challenge lay in how the drink is served. The three-part pour process was seen as too onerous and time-intensive for the incoming generation. It was believed that younger customers would simply favour conventional beers.

But rather than change the classic Guinness formula to something “faster”, the company decided instead to reframe this apparent disadvantage as a feature.

So they doubled-down on the triple pour, and crafted a masterful advertising campaign implying that the good things in life are worth the wait.

Out of this campaign emerged a TV spot (The Surfer) that is widely regarded as one of the best advertisements of all time. Give it a quick watch:

In the ad, a wisened old surfer waits for the opportune moment – accumulating adrenaline & focus – and then suddenly pounces into the water, charging into the waves. The scene ends in a celebratory “debrief” on the beach with his friends.

The wave itself is a surrealist visual, inspired by Walter Crane’s ‘Neptune’s Horses’ painting; the implication is that glory belongs to both the bold and the patient.

The full story is worth a trip down the rabbit hole for any creatives who jive on this stuff.

It was instrumental in reviving a brand that would’ve otherwise had its best years behind it. And it’s a great example of re-framing perceived weaknesses as core strengths, simply by telling the right story.

When the world changes, adaptation is critical. But sometimes this takes more than simply adjusting the usual levers like pricing, product strategy, etc.

Sometimes the best way to meet the moment is with a new story. For our customers, our teams – and ourselves.

Normal 2.0

Without belabouring the obvious – to say we’re now in a world changed is an understatement.

With COVID-19 likely in the rearview for the most part, and the world re-opening, I think we’re now starting to see the real impact of its social, economic & political disruption.

Widespread inflation. Civil unrest. A looming recession that seems all but inevitable. And very regrettably, now a war.

Only one thing is certain: Uncertainty. I don’t think we’re getting back to the “normal” of 2019. Whatever 2022+ is, it’s our world now.

So what do we do? What’s the story from here?

Honestly, it’s a big, fat ‘I don’t know’.

But even in the absence of knowledge, one can still be an active observer and wait for recognizable patterns to emerge. With that objective in mind, here’s how I’m approaching this both as an investor and an entrepreneur.

As an investor: Basically I’m just sitting back and trying to get a sense for how key indexes & asset classes are responding to the daily deluge of events. (Specifically stocks, real estate and crypto).

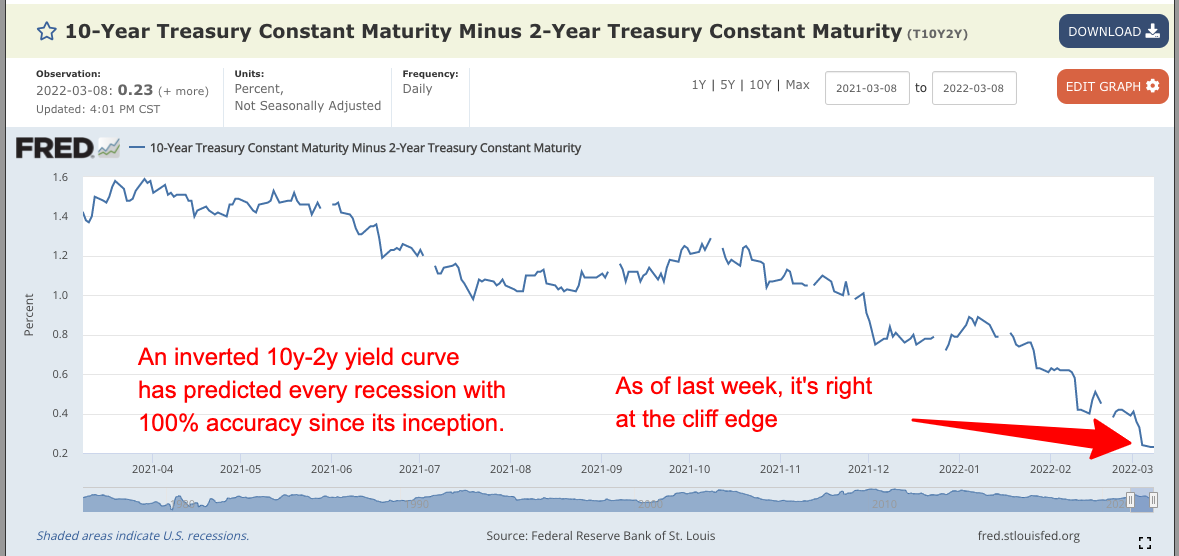

I have some cash on the sidelines, but nothing feels like a “no-brainer” right now. Things are way too volatile, and given that we’re on the precipice of an inverted yield curve, I suspect we’ll see some much deeper bottoms (across the board) before settling into a support zone.

Another reliable indicator of recession has been a sudden rise in oil prices…

For most of us, the best strategy is going to be to wait this out and see where things go. I’d avoid short-term trading, and instead wait to buy good companies / assets at a great value once they’ve rounded off the bottom, and once there’s a durable recovery trend.

As an entrepreneur: I’m carefully looking at what reinvention & adaptation might be necessary to recalibrate my business (and by extension our research services) to a changed world.

This isn’t as simple as raising / dropping prices, or otherwise simplistic dial-turning. Just as with the Guinness reinvention campaign, there’s more nuance required…

- What’s now keeping my customers up at night?

- How can our business become a part of their new, internal hero’s journey narrative?

- What newfound challenges need to be re-positioned into features? Or course-corrected?

- What newfound opportunities need to be seized?

Again, the “action steps” currently amount to active observation. I don’t know where we’ve landed yet. But I’m consciously aware that running the usual strategy won’t be nearly as effective in unusual times.

Post-Covid, the world’s equilibrium has fundamentally changed.

If the game of life was a proverbial Scrabble box, there’s now a bunch of extra letters – just to throw everyone a curveball. It’s going to take some time for all of us to adjust, since the old “rules” won’t be as universally applicable.

Humanity hasn’t changed, though, and neither has our core psychology.

So the basics of selling, business modeling & storytelling is still intact. Reinvention in that context is more a matter of re-applying those core principles in a new environment – once the new environment is better understood.

out of crisis… mini-golf?

The origin story of mini-golf is bizarre…

While it existed to some degree as ‘Peewee Golf’ in the 1920’s, it was following the economic collapse of 1929 and into the Great Depression of the 30’s where mini-golf truly became a nationwide phenomenon.

In the midst of widespread hardship, tens of thousands of mini-golf courses emerged across the United States, for a few reasons:

- It was cheap, fun & entertaining. With few able to afford the luxuries of fine dining, going to the theatre or similar outings on a regular basis anymore – the general public quickly flocked to affordable alternatives. Mini-golf fit the bill perfectly.

- It was a way to re-purpose defunct spaces. As values plummeted, lot of commercial real estate became either vacant or underutilized in the 1930’s, and some of it was creatively ‘re-purposed’ into mini-golf courses by resourceful entrepreneurs; they were cheap to build, and it was a way to generate some incremental revenue while waiting for better times.

- It was a fun way to build “micro-empires”. As the pastime grew in popularity, proprietors had to come up with increasingly novel & elaborate features on their courses to draw crowds – this is why things like windmills, castles, water hazards and other gimmicks are so prevalent today. But it was also a way to re-engage with capitalism in a low-cost, low-risk model… where fun factor was the success determinant – not just budget.

- It was a welcome distraction. I’m somewhat repeating #1, but at a more emotional level, people simply needed an escape. They needed a way to suspend the terrible reality of the Depression on a Saturday afternoon, even if just for a few hours.

Note: For the curious, 99% Invisible has a great podcast that tells the story in more depth.

I don’t know if we’re entering something on the scale of the Great Depression – but I’m fairly confident that we’re in for some less than amazing times, economically at least, for the next few years.

And as a result, I predict that we’ll see modern versions of “mini-golf” emerge out of today’s cauldron of uncertainty.

My bet is that the Metaverse – and by that I mean the collision of digital entertainment, social media & the virtual economy – will have a large role to play.

In some ways, it’s an uncanny digital successor to mini-golf; it offers entertainment, escapism and low-risk entrepreneurship, all in one.

History often rhymes, I suppose.

The three-part pour

Just as one must wait for the foam to settle out on a proper Guinness pour – we need to be deliberate in waiting to see what settles out of current events, before making any drastic decisions.

This year – possibly even this decade – will test us. And my heart goes out to anyone personally impacted by the Ukraine invasion, in particular. It’s honestly hard to believe what’s happening.

But life will go on, and we will find our way.

If we view the world through the right lens, and if we’re ready to act when the opportune moments arise – then we can ride generational waves of opportunity, even in the roughest of seas.

Last – it’s worth mentioning that there were a lot of millionaires minted during the Great Depression, as well as the ’08 Crisis. Events like this are kind of like a big reset button – and wealth can often be redistributed in surprising ways.

So if you can keep your head amidst intense volatility, the opportunities (and asset prices) that present themselves can be life-changing.

A few housekeeping items:

As most of you might know, we launched Insiders a few months ago. It’s our core research service (“surf report”) that finds asymmetric opportunities for entrepreneurs.

This has really taken shape since the initial launch, and we’re steadily adding new reports. If you’re still on the waitlist but not yet a member, just a heads up that we’ll now be sending out a quick preview each time a new report is posted for members.

And for the overall newsletter, I’ll be sending out a monthly Insiders preview / recap starting this month.

Also – I mentioned that we were planning to release “Conduit Method, 2022 Edition” in the near future. That’s still in the works – but I’ve had to push back the release until April.

But as per the Guinness slogan, good things come to those who wait 😉

Talk soon,

~ Chris

Hi there Chris, would you say that your 7 figure consulting model is the best business to start moving forward, as you can have multiple projects on the go, so you’re diversified in these uncertain times?

Hi Edward,

I would say it’s the most versatile & low-risk approach to entering a market, where there’s still substantial upside. And given today’s uncertainty, you could definitely do a lot worse.

It’s more a question of whether consulting is good fit on a personal level. Some people love it and thrive on balancing a few key clients. But it’s not everyone’s cup of tea.

That’s the main qualifier IMO. Basically, yes, it’s a great business model, particularly right now. But be honest about whether the required networking, biz dev conversations, etc. are in your lane.

Hi Chris, Patrick here.

IMHO we are headed for a recession of some sort in the not too distant future. if that turns out to be the case silver is a pretty great buy right now considering it’s price means it’s virtually on sale!

With Russia, the UAE and China now all off SWIFT and the US not buying Russian oil, Russia is now effectively decoupled from the West (which was one of Putin’s goals, an our leaders did it for him, which he knew they would via sanctions).

The UAE is now trading a percentage of their oil contracts, Russia all of them and China all of them with the Yuan as the reserve currency using their SWIFT alternative they already had in place for a few years.

This means that the dollar just lost a chunk of it’s Petrol Dollar status and I would suspect other countries that by Russian oil will have to follow suit by adopting the Yuan as their reserve petrol currency as well or at least a dual reserve currency.

This does not strengthen the dollar but weakens it.

Just my assessment.

Patrick

Hi Patrick,

Definitely agree re: silver, I have a good chunk riding on that 🙂

I also think the dislocations & fundamental “rewiring” of the global economy – things like the shift away from the US Petrodollar, East vs West dynamics, and essentially some kind of Cold War 2.0 reality going forward – are going to set off a series of unpredictable volatility & chain reactions across all kinds of markets and in all kinds of ways.

A very small example – I’m a Uranium investor, and Russia supplies ~ 40% of the world’s enriched U308. Kazakhstan is similarly the world’s largest raw Ur supplier, and has typically moved it to market via Russian ports like St Petersburg.

So this has the potential to wipe out something like half of the global uranium supply, overnight. That’s either catastrophic or euphoric, depending on how you’re positioned. But overall, obviously, a net negative for the world.

What a different world vs 4 weeks ago.

Anyway, regardless of the near-term madness we’ll see as everyone wraps their head around everything, over time expectations, reactions & projections will recalibrate to some form of normal, and we’ll at least have a foundation of reality on which to base decisions.

Hopefully that comes sooner than later.