Are you a fan of scary roller-coasters?

I’m not an avid enthusiast, but they don’t bother me. For some reason, I’ve always enjoyed the sensation of total surrender as I’m being hurtled down a track in what is essentially simulated chaos. It evokes a sort of placid calm, where I’m able to objectively immerse myself into the experience – largely because I have a logical “trump card” that I can rely on if needed.

The ride will end in 90 seconds, thousands of people do this every day, I’ll be fine, and then I can go eat a hot dog.

So for whatever it’s worth – and even through the lenses of my apparent tolerance of measured risk – the near-term future has me sweating bullets.

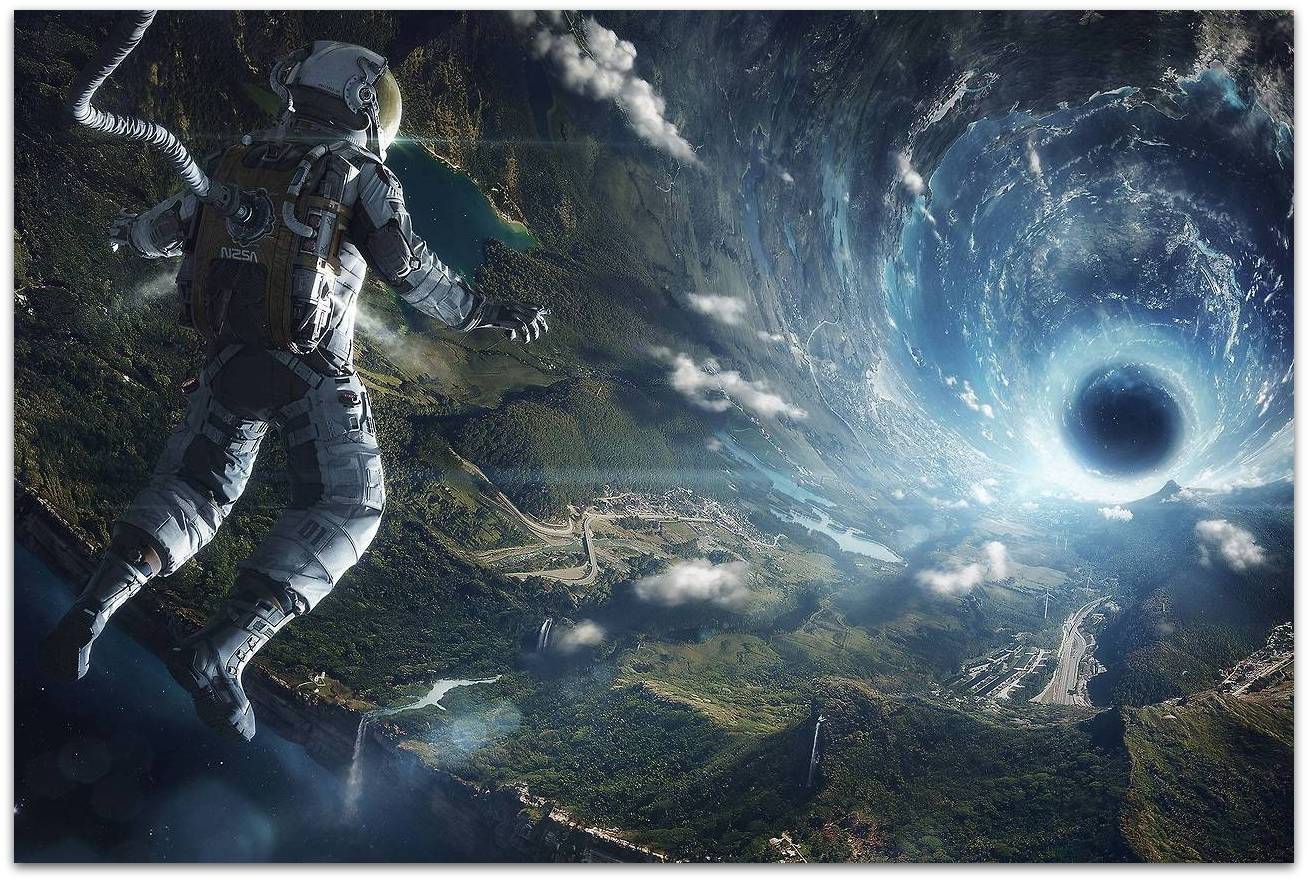

Because as I see it, mankind – the West in particular – is transiting across a technological “event horizon”, and has begun its descent into an economic black hole of its own design.

I’m not scared of our inventions, advances or discoveries in and of themselves. We’re developing lots of great stuff, for sure. Much of this is discussed further down.

Rather, what legitimately scares me is the rate at which we are cannibalizing the fabric of our economy as a natural byproduct of our technological “renaissance”. Because even if the outcome is ultimately positive – in the meantime, it’s going to be one hell of a ride.

And there might not be any hot dogs to comfort us once the ride is over.

That’s why I decided to sit down at a nearby hipster cafe, open the laptop, and share the following:

1) Why I think this isn’t bullshit

2) Various predictions, and

3) My little plan for capitalizing on all of this in the meantime

Sound good?

Let’s begin…

Let me explain why I think this is a rational concern:

To set the context, let’s first start by examining what’s already happened in the last 10 years (from 2005 – 2015), across a few key verticals.

These canaries in the coal mine are just a few examples, but hopefully they can effectively pull back the proverbial curtain on our “observation deck”, from which we will then evaluate the black hole into which we are inexorably descending…

—

* The First Canary: The Big Retail Rollup…

This is an obvious example of how the internet (even pre-mobile) can dissolve entire channels – let alone industries.

In 2005, ecommerce was largely relegated to Ebay (back when it was actually individuals selling random junk), along with a few specialty e-tailers. Amazon was already a giant, but not nearly the global behemoth it is today. At most, ecommerce was viewed by most brands as an additional “bonus” sales channel. A fancy gimmick to dangle in front of impressionable investors, and perhaps somewhat of a booster for the monthly P&L’s.

But for the most part, online commerce was for the very choosy customer who was in the market for something particular, or even obscure. Most people still consumed from traditional brick & mortar retailers – mostly because it was still more convenient, and because the existing supply-chain logistics (from business to consumer) were fairly sluggish. You had to sacrifice convenience (and time) for choice.

Fast-forward 10 years… and you have a very different situation.

The future of big-box retail is, at best, grim. Most optimistically, the once-massive department stores will transform into small showroom “hybrid” boutiques, showcasing key brands, and assisting customers with their online purchases. Meanwhile slashing their square-footage (& payroll) by orders of magnitude.

And this approach – boutique showrooms – will increasingly just be enacted by the brands themselves, as the need for a physical middleman continues to diminish. Walmart’s days are numbered.

We’re going to see a lot of companies following Apple’s lead by opening “brand experience” locations, rather than focusing on traditional retail channels. If everyone’s just buying from you via Amazon anyway, why bother slicing up your profits across layers of distributors & retailers?

In a nutshell, barring a few exceptions (like clothing), big box retail is in its death throws. Its only chance for survival is through a drastic metamorphosis… which, ironically, will only serve to further increase the critical mass of Amazon & other similar digital marketplaces.

What about 5 years from now?: I predict that as “retail” increasingly transitions to the brand-showroom model, we’ll ideally see this coalesce with a sort of “beautification” of downtown & shopping spaces. Going shopping will take on a whole new meaning… as it no longer entails filling up a cart, and waiting in line at the cashier (albeit with the exception of groceries/convenience items). It will now become more of an experience, and probably more social. And it should bolster more demand for products made & sold directly by local artisans – since reselling imported inventory won’t be commercially viable.

This will have a steep cost, though. Wealth will increasingly consolidate to fewer entities, and the necessity for human intervention (sales, logistics, support, expertise, etc) will continue to decrease. This will result in net employment losses, as well as net tax revenue losses at the municipal, state & even the federal level – since most of these mega-corps will likely be HQ’d offshore. This will further widen income disparity, while also increasing the tax burden on small business & individuals due to the resultant shortfalls.

—

* Canary #2: Data Killed the Video Star…

Some time ago, I remember watching an episode of Dragon’s Den (our Canadian version of Shark Tank) where the inventor was pitching his alleged solution to digital piracy, called “SmartCD”. The episode aired in 2006.

It was essentially an additional chipset physically embedded into CD’s & DVD’s, making it impossible to copy the media contained. The founder was emphatic that this patent-pending solution would herald in a new era of copyright protection.

The show’s panel of investors was less certain. In particular, Kevin O’Leary (the show’s outspoken “villain”) predicted that his product would have an 18-month window, at most, to get to market before the delivery medium for digital products like software, music, games, and so on – namely CD’s, DVD’s and other traditional forms of portable data storage – would begin a trajectory of rapid obsolescence.

At the time, I remember thinking that O’Leary was just sounding off some hype to prop up the show’s ratings. Which was probably the case, but still… 18 months just seemed ridiculously unrealistic.

I was wrong.

Not only was O’Leary (probably unwittingly) correct in his prediction… but the industry fallout was far faster & greater in scope than I’d imagined possible. The death of the disc, so to speak, has massively disrupted the entire digital landscape – spanning every connected industry at large: music, entertainment, software, gaming, communications… not to mention the hundreds of spinoff industries therein.

The ramifications of the disc’s rapid decline bordered on unbelievable:

– The traditional music industry basically disintegrated overnight. Former industry titans like HMV & Virgin Records (along with virtually every other record label / retailer) have wittled down to a microscopic husk of their former greatness. Thanks to the rapid democratization of digital music availability (legally or otherwise), the near total destruction of “music as a physical product” was swift and enormous. Within a short few years, physical albums – in any format – basically became a collectible.

– The entire entertainment industry started its ongoing collapse. Netflix was inevitable, and yet, nobody took it seriously until it was too late. And by “Netflix”, I mean streamed media in general, including YouTube. The coalescence of streamed media with smart TV’s (or devices like the Apple TV) has literally killed the neighborhood video store, overnight. And much like albums, it’s basically reduced all physical forms of entertainment media to collectible status.

The current survivors of the entertainment industry include Network TV and, to a lesser extent, movie theaters. But as cord-cutting continues, and cronyism eventually loses its grip, the demise of the former is nearly certain.

– The software & gaming industries fared far better through this transition, but there was definitely some collateral fallout – most notably with brick & mortar channels and its associated physical supply chain. In both B2C and B2B verticals for software, the death of the disc actually paved the way for a far more profitable business model – online licensing via monthly or annual subscriptions, which has its pros & cons for consumers.

In gaming, the “revolution” wasn’t so incendiary. While offline retailers like GameStop and the like have certainly taken a hit by digital marketplaces such as Steam, GOG & PSN, many gamers still prefer physical game formats, since these can be traded or sold (as opposed to digital licenses). However, much like Network TV – these days are numbered. Game format will inevitably become solely digital across all platforms, probably within 2-3 years.

In a nutshell, the death of the disc was the equivalent of a sudden nuclear strike across multiple industries (many of which will never recover)… and we’re going to keep feeling the aftershocks for a few years yet.

What about 5 years from now?: While I think the tipping point of “everything going digital” has long been passed, what still remains to be seen is just how much critical mass the current leaders will accumulate, and how many additional industries will be swallowed by their ever-expanding wake. Much like how smartphones managed to rapidly corner & consolidate not only communications – but also photography, music, reading, news consumption & computing – I think we have yet to see the final “wrapping up” of the various industries connected to digital goods.

But with certainty, in 5 years time there will be even fewer players that control the majority of the chips on the table.

—

* Canary #3: The Dog Didn’t Eat the Newspaper. Your Phone Did…

The iconic tradition of reading the newspaper whilst perched atop the white porcelain throne has been forever changed.

And while I have my doubts as to the scope of opportunities for innovation in the toilet industry – how we pass the time while sitting on them will continue to be increasingly disrupted & optimized. But at least for the moment, the majority of people on the planet have upgraded from the newspaper to the smartphone.

All toilet humor aside… as the smartphone rapidly became our favorite medium for news (in addition to everything else), the outlook for not only the newspaper industry – but journalism at large – has turned desperate.

There’s a couple core reasons for this, beyond the obvious convenience factor:

– Massively noncompetitive advertising products. Good ol’ Gordon in ad sales down at the Anytown Bugle can’t remotely compete against the mass democratization & sophistication of global audience targeting available to everyone through digital advertising solutions like Google, Facebook & DSP’s like SiteScout. Especially since you can get the same results, at larger scales, for pennies on the dollar in comparison. (Even in hyper-targeted local markets).

And since advertising is – by far – the primary breadwinner for virtually every news publisher, this is a serious problem. Especially since it’s impossible to solve, given the hard-floor cost to run & distribute a newspaper.

– Pivoting to digital wasn’t enough. Unfortunately, the ever-increasing innovation in Ad Tech directly correlates to the deprecation of audience value for individual publishers. Particularly those with high overhead.

Why? In a nutshell, it’s because “big data” allows advertisers to reach their target audience across roughly 98% of the extant internet, regardless of what site they’re visiting. This is, frankly, amazing for marketers like myself. But for quality publishers, this is bad news. Because it means that the value of eyeballs is now relatively normalized across the entirety of the web… which means that some stupid gossip site about the Kardashians can literally command nearly the same ad rates (on the exchanges) as a trusted local news authority.

Much like the death of the disc – the ship has sailed, and the end is imminent for traditional journalism. Particularly at the local level.

What will survive is a digital adaptation of journalism, but it will probably be consolidated to the state / national level, perhaps with coverage in the largest cities as an exception – simply because it’s no longer economically viable to pay for localized journalism. And this includes local TV news, as well.

What’s the 5-year outlook? For journalists & peripheral roles (camera operators, pre-production staff, studio techs, etc), very uncertain. My prediction is that most journalists will basically end up having to put their entrepreneur hat on and build their own audiences to which they report. We’ll see more “niche” news startups like VICE, but these will mostly consolidate into specialty verticals at the national level. Municipalities & smaller communities will increasingly be ignored.

Most “news” at the local level will largely just be crowdsourced from individuals via social networks. If local news does make any kind of professional resurgence, it will almost certainly require government subsidization (similar to CBC or BBC). Which will, of course, further increase the tax burden for individuals.

—

* Canary #4: Your Phone Also Ate the Taxi Industry. (And it’s Currently Swallowing the Hotel Industry)…

The rise of Uber has been nothing short of astonishing. Just 5 years ago, Uber was a fledgling “scribble on a napkin” business. Today it is literally the largest taxi company on the planet and growing… with a fleet of zero cars.

Similarly, AirBnB has rapidly overtaken the vacation rental industry – seemingly overnight. Its now-distant rivals like VRBO & HomeAway simply couldn’t stack up to the dynamic ease of use that AirBnB offers its userbase.

So as a result, AirBnB will inevitably become the world’s largest “hotel” company… again with zero real estate or infrastructure.

These examples are particularly important, because they’re examples of how massive infrastructure can be entirely supplanted by an interface. Whole industries can now be cornered by a single entity with the right app. The “replacement infrastructure” can simply be created on demand at the peer-to-peer level, thanks to the universal capabilities of everyone’s smartphone.

And as we’re seeing increasingly, the conventional industries who are being supplanted (taxis, hotels) are increasingly deciding to join these ecosystems just to survive. At least in regions where regulation has failed to keep the wolf at the door… which is ultimately just a temporary setback.

Much like with Big Retail’s transition to showrooms , this survival mechanism ultimately just adds to the critical mass of the digital takeover – adding even more inventory into the marketplace.

Uber & AirBnB are just the beginning. We will see countless industries previously reliant on their “infrastructure barrier” swallowed up by various interfaces.

We’ll revisit the enormity of these implications further down.

What’s the 5-year outlook? The “Uberfication” of an increasing number of industries is inevitable – and it will happen virtually overnight. Especially as the population at-large grows more and more accustomed to using the on-demand, P2P economy.

In some industries, the net result for individuals (good or bad) might ultimately be neutral. P2P infrastructure creates employment, by design. In others, there will surely be a net loss of some kind as the real wealth ultimately flows upward to the house platform(s).

The larger damage in the short term may actually be caused by Airbnb – which could act as a catalyst for increasing the average rental prices in larger cities (and therefore the cost of living). Regulation may be a required to limit the usage of short-term rentals in certain building types, or zones.

In the long-term however, transportation apps like Uber will very likely spearhead a tsunami of job-losses across the whole of the transportation sector, especially given that their apparent objective is to eventually replace their “workforce” with self-driving cars. The trucking industry is also headed for the same fate, which will result in the net loss of of millions of jobs.

Similarly, I expect that most of Uber’s spiritual successors across various industries will similarly transition away from P2P functionality, and towards near-total automation. The gig economy will simply serve as the “stepping stone” towards these inevitable transitions.

—

These “canaries” are just a few examples of how quickly an entire industry can turn upside down, in the face of seemingly small – or even unrelated – innovations.

And those canary examples are old news. What we’re currently facing will prove far more tumultuous, and effect millions of people.

So… what are we currently facing?

As I see it, we’ve basically created a war on jobs – unintentionally. In fact, most industries are already well past the point of no return, as each spirals down its own unique pathway towards large-scale automation – propelled by competitive pressure, profit, and most accurately – the will to simply survive.

And while the current actions of each industry (and the millions of decision-makers therein) are almost certainly borne of healthy aspirations – such as growing their company , or even altruism – the mass effect isn’t unlike a herd of wildebeests trampling through various ecosystems as they stampede by the thousands across the grasslands.

Obviously each individual is just making logical decisions. But regardless of motivations or intent, the fact remains that collateral damage is always inevitable. And in this case, it’s the middle class that’s getting trampled.

So if we’re in the midst of a mass-migration… what’s our destination, exactly?

Well…

Here’s the Thing About Black Holes…

Scientists understand what they are, how they’re created, how they behave, and how the really “big” ones are essentially gravitational anchors for most galaxies, including our own.

Make no mistake, though – nobody has a goddamn clue what’s actually inside a black hole. Or what ultimately happens to stuff that traverses the event horizon… the point at which the speed of light is an insufficient escape velocity from the singularity at the “core” of a black hole. (Once you go past the event horizon, there is no coming back.)

There’s many hypotheses… but that’s a whole other topic.

The contextual takeaway here is this:

We truly have no idea what awaits us at the end of our well-intentioned experiment.

As I see it, the point of no return is the runaway pursuit of automating human intuition. Because once our robot counterparts can “out-think” us… what do we have left to offer?

I don’t think this is sensationalist. Think about it:

The 20th century gave rise to all kinds of mechanical automation, as well as a globalized workforce. As a result, in the West, specialization became the conventional insurance against irrelevance, especially for the middle-class. As long as your job description couldn’t be viably outsourced or automated… you were relatively safe.

That is no longer the case. We are rapidly filling the gaps, and advances in specialized automation are flying forward at incredible pace.

And it’s not like this is some big conspiracy. The commercial incentive for the development of machine-learning systems, and other forms of artificial intelligence (AI), are obvious. Every salary that doesn’t need to be on the “burn column” goes directly to the bottom-line. And moreover: software doesn’t “get tired”, take vacations, sue for harassment, or require pep talks.

It also scales to near-infinity. For example, the millions of truck-drivers who will inevitably lose their jobs by the early 2020’s will likely be replaced by a handful of self-driving algorithms.

Furthermore, your average business doesn’t have to somehow figure out how to build their own AI. There’s already a multitude of tech startups offering on-demand AI. Probably within 3-5 years, we’ll see hundreds, or perhaps thousands of automated intuition “apps” available to anyone who can hook up to a simple API. Across every conceivable industry.

For example, the startup Indico claims to offer human intuition at scale. If you can install 5 lines of code, your app can now “think for itself” based on whatever data you input.

Similarly, the runaway economic fallout (hundreds of millions losing their jobs to automated intuition) does not require the existence of a skynet-type “super intelligence”. On the contrary – even the rudimentary forms of AI that we already have are more than capable of swallowing up millions of jobs.

In fact, literally as I type, there are hundreds of well-funded tech startups currently designing, developing & actively commercializing highly-specialized AI programs – just like Indico – across virtually every industry. And this is only becoming increasingly viable due to the sheer volume of data openly available to developers, the fact that basically every viable consumer uses a smartphone, and the increasing shift towards connectivity across more and more “every day” devices (aka: IOT).

AI is already a viable replacement for a significant portion of professional occupations as well. Doctors & lawyers are just as much targets as truck-drivers. With the first “AI Lawyer” already employed, and with the inevitable move towards sensors & wearables diagnosing the majority of people’s health issues in the next 5 years – being a specialist, in and of itself, isn’t enough to shield yourself from obsolescence.

In fact, the Bank of England estimates that we’ll see just shy of 100 Million jobs being swallowed by automation in the next decade alone. And to clarify, that’s 100M in net job losses… meaning that those people won’t get “re-employed”. Personally, I think 100 Million in net job losses is being conservative, as is their estimated time-frame.

Look at how quickly the “industry canaries” (above) managed to either collapse, or shrink to near irrelevance. We’ve seen entire industries that employ millions of people pretty much evaporate in a matter of months. Some are entirely vanished (like video rentals), while others are basically just circling the drain (record labels, local news, taxi-cabs… the list goes on, and will only get larger).

And virtually hundreds of other industries are already in the crosshairs.

So I think the fallout will be significantly greater. And I have no idea what that really entails.

A few things are certain, though:

- Wealth disparity will further increase (possibly by orders of magnitude) as the key infrastructures of commerce are consolidated into key interfaces, and controlled by key algorithms.And just as Google “owns” search, Amazon “owns” retail & and Facebook “owns” social… other winners will emerge as the “owners” of every respective industry, that control the sandbox that everyone else plays in.

- Lots and lots of people will see their income-earning capabilities decrease as the value of specialized human intuition depreciates. Many educated workers / professionals may find themselves climbing down the proverbial ladder just to find employment – or in some cases becoming the custodians of the technology that has effectively replaced them. Rather than technology supporting our careers, our careers will revolve around supporting our technology. This will particularly impact the middle-class.

- The gig economy will temporarily flare up in various sectors. But, as with Uber’s move towards self-driving units, these “opportunities” will eventually be diluted or replaced with automation.

- A significantly higher rate of people are going to try and start a business, or otherwise attempt to become self-employed. This won’t simply be an expansion of the “killer-app” startup culture that already exists. Rather it will mostly consist of people who are no longer conventionally employable in their field. They’ll try and forge their own way, since the only other option is to descend the ladder and work “below” their training (and lifestyle).

- Higher education (and its associated 5-6 figure price tag) will become increasingly irrelevant as its ROI becomes decreasingly evident. Millions of students are currently in debt up to their ears, only to graduate into a world that won’t hire them. The collapse of conventional academia – at least in its current form – is nearly certain.

- Despite the optimistic chatter around Universal Basic Income and its various counterparts, the public sector will remain woefully incompetent, and doesn’t have a snowball’s chance in hell of being able to react to any of the above in any timely or meaningful way. At least, not any time soon.

But, even with all of that said, and for whatever it’s worth…

Here’s How I Plan to Pillage the Pirate Ship Before it Sinks:

Nobody has a goddamn clue what we’re going to be facing on the “other side” of our own, unstoppable race towards the irrelevance of human intuition.

Perhaps what awaits us is a technological utopia, where we can successfully divorce the concept of money from work, and bask in the newfound abundance afforded to us from renewable energy, universal bitcoin allocation, exponential scientific discovery through the advent of AI, indefinite lifespans, and total economic automation.

Or, perhaps the income-gap will widen to the point where the world’s 1% “ruling elite” will subjugate the billions of unfortunate schlepps who happened to not be oligarchs or tech titans. The schlepps will then have to eek out a shitty existence, fighting over the remaining scraps on a climate-changed Earth, while the 1% club gets to live in an Elysium-style, off-planet utopia, shagging their genetically-perfected trophy partners and sipping champagne from the safety of their beautified space habitat, as they contemptuously laugh at the schlepps down below, in between bites of their ostentatious kale-flavoured space salads.

Or, more likely – we’ll arrive at something more in the middle of those extremes.

But regardless of how things turn out – I can assure you that during the course of our descent into the unknown over the next decade – things are gonna be volatile. Especially for the middle class.

Volatility is a double-edged sword. In general, it creates fear. And while fear can erode consumer confidence – it can also catalyze mass-scale momentum towards newfound necessities & 11th-hour solutions, driving an astronomical growth rate for any business smart enough to sell those solutions/necessities when the masses want them.

(Even the shittiest salesman can make a fortune selling water in the desert).

This is what has the marketer in me closely scrutinizing my crystal ball, trying to arrive at some clear opportunities through the fog of speculation.

And so far, here’s the (massively abbreviated, and slightly anonymized) gist of my own little “plan” to cash in on the end of days. So that I, too, can live on Elysium eating space salads:

————–

Chris’s Little Plan:

AI, machine-learning & otherwise digital automation are either revolutionizing – or about to revolutionize – every industry.

We already discussed how & why. (See all of the above).

But in order for any business or organization to meaningfully “join the AI party”, they need to do two things, starting yesterday:

1) Collect their own data; and

2) Know what data to collect

Once they’re collecting data that matters (which depends on their objectives, as well as extant & future technologies), there’s already hundreds of ways to start monetizing it very effectively. Aside from the obvious marketing applications, there’s also things like internal streamlining and BI insights that can lead to pivotal, game-changing discoveries. And that’s right now, today.

Currently, things like AI, machine-learning and even “big data” are basically just curiosity items for most businesses. (Just like how the “mobile revolution” was still a buzzword 5 years ago).

But in 3-5 years time, utilizing AI specific to your industry won’t just be a best-practice… as a business, it will become essential.

And the more data you start collecting now, the better off you’ll be, then. Period.

So, my plan isn’t to somehow try and compete with IBM, Google, Facebook, Elon Musk, and god knows who else (probably every PE firm ever) in the race to develop “real AI”.

Instead, my plan is to facilitate the nuts & bolts of what will your average business will inevitably require to actually utilize AI, for themselves, when the time comes.

How, exactly?

Well, the most important part of my little plan is not telling you until it’s ready 🙂

—————

So folks, we’ve reached the end of my desire to continue adding to this post.

But hopefully this mess of a blog post has been able to partially convey why I think we are the blissfully ignorant authors of our own, impending economic demise (at least in its current format) and the future is uncertain, at best.

And whether the next decade brings about the emergence of a malignant super-intelligence that eventually turns us into comatose batteries to fuel its existence, or we simply all lose our jobs and collectively starve in the forest while the Elites laugh at us from space…

…one thing is for certain:

Whatever your situation – if you aren’t preparing for this, you’re screwed.

—————

Okay everyone – have a great weekend!

🙂

~ Chris

Hi Chris. I got myself comfortable, poured the Americano full to the brim & soaked in the wisdom over a 5 Minute break. What you have shared here is a BIG wake up call “To those who have ears”. The post made me both sad & happy. Sad because I see great suffering ahead (both mentally & physical) and happy because as for my house, we are getting ready & preparing for the next 20 yrs.

If you allow yourself to continue to be brainwashed by the Mass media & dont shout (Or scream) “WAKE UP!” – then as you say its going to be a bad deal for those 100 Million (min) who won’t know the Who, What & Why….when it happens. I am involved in different social projects for “change” and I can tell you as much as I know anything we are heading for Massive changes, either by natural (finite natural resources end game) or by “manufactured” events. Asleep at the wheel will be no excuse for those reading this, in all ways – Prepare for the changes, become Proactive and keep awake!

If you have studied both Geo politics & Economics you will be aware of the fact that our present monetary policies are based on nothing but thin air & trust. For a primer study this soon –

http://www.peakprosperity.com/crashcourse

To see where were heading in REAL TIME.

http://www.nationaldebtclocks.org/

http://www.eudebtclock.org/

http://www.debtbombshell.com/

There are many many Factual based sites out there that see behind the curtain and are linked to one main theme – The Central Cartel Banking system. (BIS, IMF, WORLD BANK, FED, BOE, BOW, etc) I will leave you & your viewers to discover more by spending an hr watching this summary http://www.youtube.com/watch?v=5hfEBupAeo4

Ending on a more positive note, I now offer advanced Intel on all aspects of Business Intelligence including keyword & market research in emerging markets. More importantly, when I discussed the BOE 100 million report with my 12yr old and asked him what he thought he should do – His answer was to start a business helping those who will be made redundant to “start their own business!”. This is what I have been focussing on and thanks to Posirank I have been building my long term assets in Consultancy, B2B VRE & BIC 🙂 (Posirank built this for me – http://www.BusinessIntelligenceConsultant.org )

All the Best to you Chris & Everyone reading this, Always Have HOPE. (Hope is the road, Faith is the victory. – Martin Luther – “Everything that is done in the world is done by hope.”)

Great post Chris – I’ve had conversations around this same topic with multiple friends. The scary thing is we know AI is coming, if not here already, but once it actually arrives and is implemented to any significant degree, the rate at which it’s acceptance and use will multiply will be at a scale that is probably hard to conceive.

If you look at where we are now with AI as a single blade of grass on a football field, it won’t take long for AI to occupy every blade of grass on half the entire football field, and just keep expanding from there. The rate of expansion and it’s corresponding impact on society will likely be far greater than our overall ability to cope with it economically.

The gap between the have’s and have nots which has already exploded over the last 15 years, will accelerate rapidly.

Will governments and economic systems be able to adapt? Will the populations allow time to adapt?

Will a college degree that isn’t super specialized become useless?

The entrepreneurs will do well, but the massive middle may completely dry up.

The only area where I can see AI taking a bit more time and having a less immediate impact is in skilled trades. Plumbers, electricians etc.. But even there, how you secure those services will change – But just watch out for when they can make a toilet fix itself..

Dave

Very good points Dave, especially on the aspect of trades / maintenance.

This might remain “safely” in the human domain for awhile, but I’m sure it won’t be long until it makes sense to mobilize the production of things like installation bots. For example, there’s a lot more of this happening in housing construction already – building a house these days is more about installing a whole bunch of pre-fabricated puzzle pieces than it is about “building”.

With the rise of 3D printing at large scales, and increasingly “done-for-you” biz models encroaching into the industry – it won’t be long until the only construction “jobs” left are basically machine babysitting, custom work, or renovations.

I think this will be the trajectory of all the other trades, in time, as well.

Oh, also – let’s not forget the potential for bureaucrats to successfully complicate the advent of “AI” with stuff like this (proposing that robot “owners” pay into social security & taxes on their behalf):

http://www.reuters.com/article/us-europe-robotics-lawmaking-idUSKCN0Z72AY

Sounds completely ridiculous on the surface. But on reflection, I suppose taxation on “electronic persons” may well be required to facilitate things like UBI.

Imagine that. Robots, electronic persons (AI’s) & businesses as the new tax base.

Crazy.